Make your contribution. After you’ve designed an account, you’ll should deposit revenue so that you’re able to make investments.

The top brokers for beginners present a combination of reduced charges, beneficial educational articles in addition to a wide investment range. Our testers also look for trading platforms which can be very easy to navigate and flexible when you grow your skills.

Permitted Investments The key advantage of opening an SDIRA is the chance to put money into numerous types of asset lessons. Though these may well crank out spectacular total returns, there's no assurance of end result.

S Corporations: For context, an S corporation is a small enterprise composition that pays taxes just like a go-via entity, indicating the income or losses go on to the shareholders’ tax returns. In the event your IRA retains the shares of the S corporation, it loses its tax-advantaged standing.

Look for a dependable custodian: Decide on a custodian seasoned with self-directed IRAs and Verify their fees and expert services.

Generally, we eat amongst 70 and 88 micrograms of silver per day, 50 % of that amount from our diet regime. On the other hand, people have advanced with economical ways to deal with that consumption.

HELOC A HELOC is usually a variable-price line of credit score that permits you to borrow funds for just a set interval and repay them later on.

This means the account is handled as though you took a a hundred% distribution of The cash on the primary working day with the applicable tax 12 months when The foundations were damaged, and that comprehensive quantity is taxable as common profits. Home Page According to your instances, This may certainly be a whopper of a tax Monthly bill, so it pays to this article Adhere to the principles appropriately.

How to Start Investing Using an SDIRA People who need to take full advantage of alternative investment opportunities, and who may have carefully analyzed the risks, really need to investigate which custodial account companies get the job done ideal for them. Look at using these actions:

These forms of assets could have returns greater than you could potentially get investing in just the inventory market place, but Additionally they entail A great deal greater dangers.

You could invest in a wide variety of alternative assets that usually fall outside what most monetary establishments have the ability to handle.

Such a IRA permits you to keep alternative investments in a very retirement account, nevertheless it includes complex procedures and hazards.

A lot of people very own gold as a result of funds like Sprott Physical Gold Trust (PHYS) or Central Fund of Canada (CEF). After gold enters the procedure by which it can be molded into objects other than gold ingots, for example jewellery or watches, gold has undergone numerous improvements and view website mixtures that it's virtually difficult to trace it.

But what When you've got One more retirement program? The excellent news is which you could convert options such as a 401 (k) or a traditional IRA into a Roth IRA and take full advantage of their number of benefits, and now could be a great time to do so.

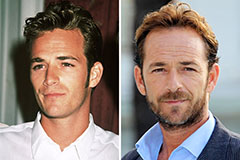

Luke Perry Then & Now!

Luke Perry Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!